A closely followed crypto analyst says that Bitcoin (BTC) could see a sharp decrease if it fails to hold a crucial zone of support.

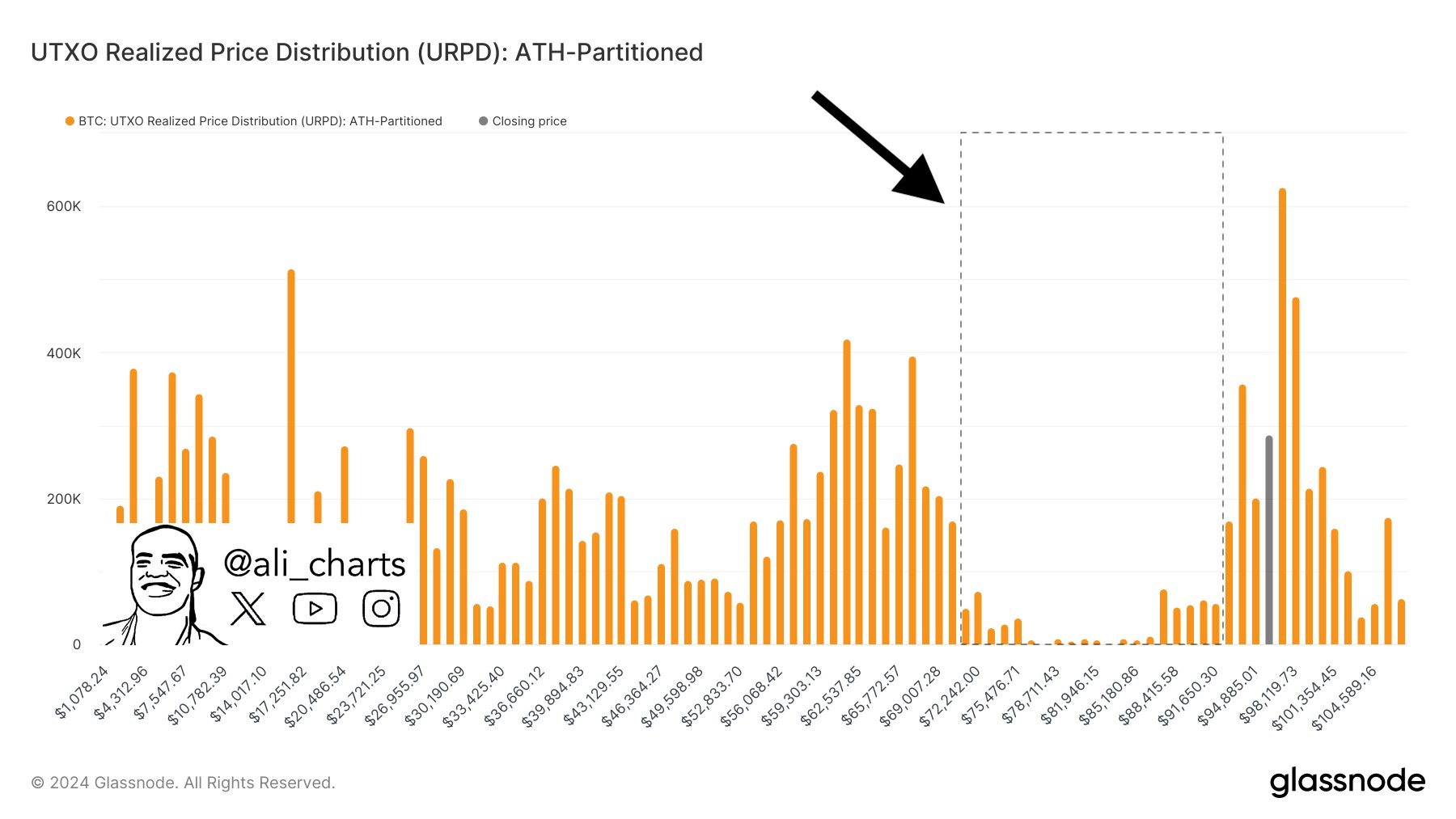

In a new strategy session, crypto trader Ali Martinez tells his 110,700 followers on the social media platform X that sell pressure could see the crypto king plunge all the way back down to $74,000 if it fails to maintain the $92,000 price level.

“A surge in selling pressure pushing Bitcoin below $92,000 could spell trouble. Falling past this level opens the door to a steep drop, with little support until $74,000.”

The trader’s chart – which uses UTXO Realized Price Distribution (URPD), a metric that analyzes the distribution of BTC’s realized price based on the amount of Bitcoin left over after transactions – shows a massive gap between $92,000 and $74,000. According to Martinez, this is Bitcoin’s “free fall” territory.

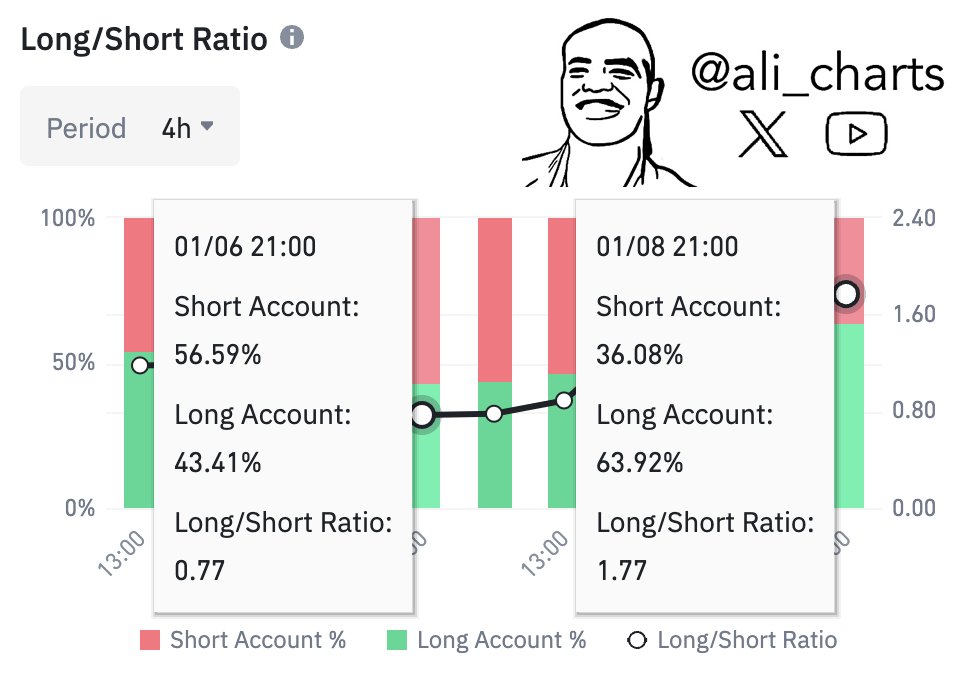

The analyst goes on to note that when the top crypto asset by market peak hit a price of $102,000, the majority of traders on Binance began to short the asset. However, now that it dipped back down to $93,000, investors are doing the opposite.

“On Jan. 6, with Bitcoin at $102,000, 56.59% of traders on Binance were shorting. What followed was a 10% [drop], sending BTC down to $93,000 today. But now, 63.92% of traders on Binance are going long.”

The flagship digital asset is trading for $93,918 at time of writing, a 1.3% decrease over the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxGenerated Image: Midjourney