The digital finance landscape has undergone a major transformation recently, with the total market capitalization of the sector rising from $1.4 trillion to nearly $1.9 trillion over the last 90-day stretch alone, thereby showcasing a growth of over 35%. Amid this rise, the value of LINK, the native token of decentralized blockchain oracle Chainlink, hit a 22-month high — breaching the $20 mark in the process.

The development has not only caught the eyes of investors all across the globe but has also demonstrated Chainlink’s growing influence within the blockchain ecosystem. Moreover, it signals a broader trend toward the adoption of tokenized real-world assets (RWAs), the market for which sat at a sizable $5 billion during the end of Q4 2023. Not only that, projections by the Boston Consulting Group estimate that the industry will be worth $16 trillion by the end of the decade.

Several factors have contributed to LINK’s ongoing surge, with a crucial one being the growing influence of Chaillink in connecting various blockchains with external data sources. Additionally, the aforementioned increasing interest in the tokenization of assets (transforming tangible assets like gold, stocks, and real estate into digital tokens on a blockchain) has also captured the attention of retail as well as institutional investors.

In fact, it is for this reason alone that analysts for K33 Research (formerly Arcane Research) have hedged LINK as a safe investment option within this otherwise uncertain economic climate.

Market dynamics seem to have further fueled LINK’s surge, as exhibited by an uptick in futures contracts associated with currency as well as pronounced acquisitions by whale wallets. Notably, Lookonchain data revealed that a single whale wallet accumulated a whopping 4,556,684 tokens — valued at approximately $83.6 million — over a 72-hour stretch earlier this month.

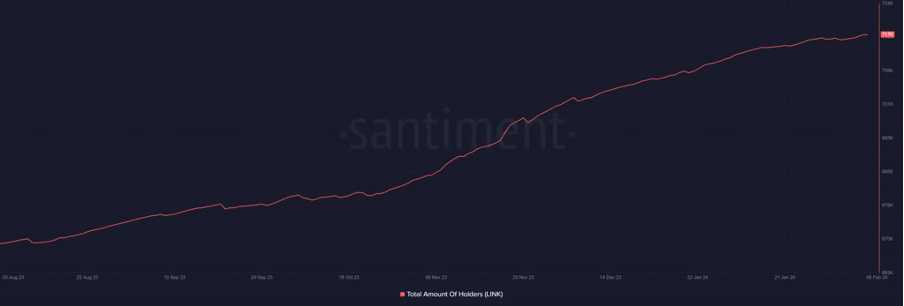

Simultaneously, the overall number of Chainlink holders across the world also increased quite notably, with data by Santiment indicating an uptick of about 9,000 holders over the past few months, totaling 717,000. This growth, alongside a trend of LINK being rapidly withdrawn from exchanges — reducing its existing supply on exchanges to about 21.5% — has ushered in a robust accumulation phase alongside a strong belief in Chainlink’s future price appreciation.

LINK Holders over the last 6 months (source: Santiment)

Providing their thoughts on Chainlink’s strategic positioning within the crypto market, CEO of LinkPool and Founding Core Contributor of stake.link, believes that since Web3 is all about improving real-world systems and processes, Chainlink is perfectly positioned to spur the tokenization of Real-World Assets (RWAs) as well as enable them to operate on a fundamental level with on-chain security and reliability guarantees, adding:

“For RWAs to thrive on blockchain networks, it’s crucial to have enrichment with real-world information, secure cross-chain transfers, and off-chain data connectivity. The Chainlink Ecosystem uniquely stands out as the sole platform capable of delivering these essential capabilities.”

A similar, complimentary perspective is shared by Prathap Simha, Solution Architect at RocketX, who emphasizes the importance of data computation and cross-chain functionalities for successfully integrating the blockchain with traditional financial systems. “I guess everyone in the blockchain space is committed to a similar goal: bringing a future where financial systems are first and foremost interconnected and, of course, more transparent, secure, and inclusive. Chainlink offers valuable insights into the essential components required for this integration,” he added.

The fact that Chainlink is positioned smack bang in the middle of the ongoing tokenization boom will undoubtedly have broader implications for the financial industry over the coming months and years. For instance, the platform’s ability to offer verifiable/efficient data sources to projects operating across different industries can help facilitate the transition towards a more interconnected and blockchain-enabled future.

Thus, as Chainlink continues to evolve and expand its offerings, the potential for further growth and adoption looks promising. In fact, stakeholders in the blockchain and crypto arena stand to do well if they continue to closely follow Chainlink’s progress, especially since it can pave the way for a more transparent, secure, and inclusive financial system.

Image: DepositPhotos